“Actuary” means a person have a knowledge in finance modelling and risk analysis in

different areas of insurance like pricing of policies, employee benefits, annuities,

pension, gratuity etc.

Actuarial Science is the discipline where you learn the effective implementation of

mathematics, statistics, and probability methods to assess the risk in insurance, finance,

and other industries and professions.

The actuaries have a skill in analysis and modelling of problems in finance, risk management

and product design are used in the areas of insurance, pensions, investment and project

management, banking and health care. Within these industries, actuaries have a vital role

such as design and pricing of product, financial management and corporate planning.

Feel free to contact us

CS1 – This will be examined in a set of 2 papers. CS1A is 3 hours paper based assessment and CS1B is 1 hour 45 minutes’ online exam which R programming along with Statistics.

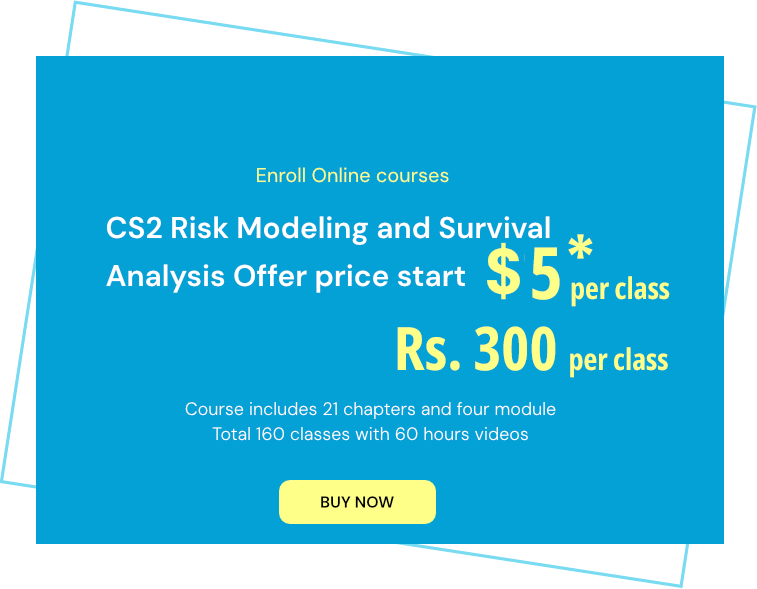

CS2 – This will be examined in a set of 2 papers. CS2A is 3 hours paper based assessment and CS2B is 1 hour 45 minutes’ online exam which R programming along with Statistics and Modelling.

CM1 – This will be examined in a set of 2 papers. CM1A is 3 hours paper based assessment and CM1B is 1 hour 45 minutes’ online exam which Excel programming along with Actuarial Modelling and mathematical techniques.

CM2 – This will be examined in a set of 2 papers. CM2A is 3 hours paper based assessment and CM2B is 1 hour 45 minutes online exam which Excel programming along with Reserving and financial market techniques.

CB1- It is 3 hours paper based assessment.

CB2- It is 3 hours paper based assessment.

Learn and Practice in

your own time

Build your confidence

step by step

Analyse your

performance

Learning through

experience

Syllabus topics covers – Stochastic processes, Markov chain, Survival models, Graduation, Time series, Loss distributions, Copulas, Extreme Value Theory, Random variables and distributions for risk modelling, Machine learning

The online class help you to understand core concepts. Each subjects required to attend 60 hrs classes.

The satisfied students should pay the fees to continue the class.

βi faculties have high academic qualifications and industrial experience. Our experienced teacher professionally engaged with students to build their confidence levels. High knowledge in statistics and finance, guide you right direction to pass the exam. A systematic approach to course notes and assignments encourage the active learning. (BAPK - Head Coach)

We help actuaries and aspiring actuaries to learn and practice the actuarial studies. Our structured training makes you an effective study habits that build your confidence to grow your actuarial journey.

“You have incredible self – discipline and always enthusiastic to complete the work. I love way you are teaching and explaining the Copulas, time series, survival models. You are well prepared for each class and very hardworking. Creative way of problem solving helped us to analyse the problems.

“When I read the subjects, I was continuously struggled to understand the concepts. You are always encouraged me to continue. It was thoughtful in interaction with you. The assignments, course notes and home works helped me to grasp a concept fully.

“You were conducted class test after every chapter and every module. The practice exam was really helped me to build my confidence. You are always available in chat and call that helped me to clarify the doubts.

“I feel difficult to solve the problems in probability distributions, Bayesian statistics, data analysis and Regression theories. You simplified each chapter along with answering the questions. You made this easy to understand. You always focused on subjects you are handling.

Actuary need to develop a continuous passion of learning. Actuarial exams are professionally designed for analyse the qualified person who

Read More

Actuaries are trained professionals in the field of mathematics, statistics, stochastic modelling, risk modelling, data analysis and finance economies.

Read More

Actuaries work with insurance and financial institutions to measure, manage and mitigate the risk. Actuarial risk examines the possibility of

Read More